Design, Build, Support, Innovate

Trusted by thousands of golf clubs across the UK&I for over 40 years, we provide a comprehensive suite of software, hardware and services designed to streamline operations, enhance member experiences, and simplify membership administration.

Our industry-leading ClubV1 platform delivers a powerful, cloud-based solution for managing bookings, memberships, competitions, and handicaps -

and is accessible anytime, anywhere.

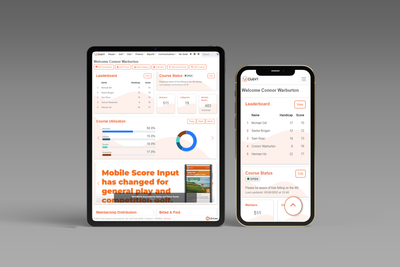

ClubV1 Admin App

You’ll get access to all of the same features as usual, from membership to billing and competition management, in a new-look design which is specifically suited to phones and tablets, making it easier than ever to ‘take your golf club with you’ everywhere.

To download the App to your mobile phone or tablet:

Apple App Store

Android/Google Store

Products

Support

Part of ClearCourse

The group has a mission to build brilliant businesses by integrating the best software, payments, services and people, and we believe that by being part of ClearCourse, we can continue to scale and grow our business, and ultimately keep improving our software for you.

Being part of a larger group brings several benefits to our business – and our customers, too.

As we are part of a larger group of software and payments platforms, we can tap into the knowledge and experience of our fellow ClearCourse businesses.

If there’s a chance to integrate our software to offer a better solution, we’ll take it. If there’s the opportunity to work strategically with them to enhance what we can offer you, we’ll do so.

A perfect example of this in action is ClearAccept, a range of payment solutions purpose built for ClearCourse software solutions like Club Systems

Their range of payment products mean that our clients can now get their software and payments solutions from one organisation, and we’ll help you future-proof your payments by continuing to evolve based on your feedback and the sector’s needs.

From a growth and stability perspective, being part of ClearCourse means we’re backed financially, so we can continue to invest in and develop our platform.

We can also tap into learnings from many other ClearCourse businesses working in the Charity and Commercial sector – meaning our platform will always evolve to ensure it’s as relevant as possible for you.

To learn more about ClearCourse, our brands, our ethos and our work, check out our website.

Howdoipay powered by clearaccept

HowDoiPay, powered by ClearAccept, is our very own integrated payments product purpose-built for our software users.

We’ve worked alongside our sister company ClearAccept, an FCA-regulated payment service provider responsible for processing transactions through HowDoiPay. By integrating with ClearAccept we’ve been able to build a range of our very own payment products specifically for our software and the golf sector.

With fast processing, easy setup and seamless integration, HowDoiPay will save you time and money while offering a payment experience your guests and members will love.

Fast payments at your club

Whether guests are renewing their membership, paying for tee bookings or ordering food and drink, take payments with fast, integrated card machines that automatically send information back to your ClubV1 system so that you can keep queues moving.

By eliminating unnecessary manual steps and human error, you get quicker payments, shorter queues and, ultimately, more sales.

Online payments made easy

Save time and reduce the need to chase payments by allowing members to pay for membership and top up their member cards directly within their online account easily, whenever it’s convenient for them.

Exclusive payment features

Customer experience is continually advancing, and your payment solutions can help you keep up. Future-proof your payments with exclusive features only available on HowDoiPay.

Payments in the ClubV1 Members Hub

Integrated refunds

Integrated virtual terminal (coming soon)

Auto-top-up

We’re continually developing based on your feedback.

Easier reporting

View transactions from all of your payment channels and card machines in one place and in real-time. It’s easy to reconcile and report on transactions, and everything will add up automatically.

Working better together

ClearAccept, ClubV1 and HowDoiPay are all part of leading software and technology business, ClearCourse.

Register for one of our Webinars

We are hosting webinars to demonstrate the benefits of integrating ClubV1 with ClearAccept; to sign up click here

Card payments are processed by ClearAccept. ClearAccept Ltd is authorised and regulated by the Financial Conduct Authority under the Payment Service Regulations 2017 (FRN 926372) for the provision of payment services.

View our Privacy Policy

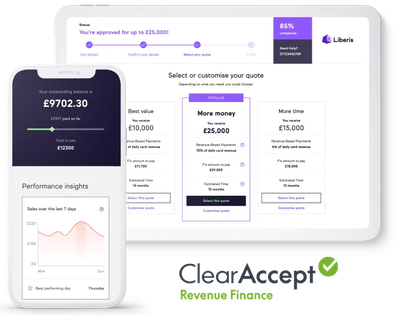

Clearaccept revenue finance

Fast, flexible funding for businesses like yours

HowDoiPay powered by ClearAccept gives you access to ClearAccept Revenue Finance, the fast, flexible way to fund your business.

- Apply online in just a few clicks.

- Once approved, you could receive your funds in less than 48 hours.

- There’s no mounting debt. You’ll pay one simple fixed fee as a percentage of your card takings.

- You can use the funding for whatever you need to give your business a boost.

Learn More

This product is provided by Liberis Ltd, Scale Space Building, 1st Floor, 58 Wood Lane London, W12 7RZ (Company number: 05654231). ClearAccept Ltd will receive commission from Liberis following a successful referral. Liberis is not authorised or regulated by the Financial Conduct Authority. Your funding is not protected under the Financial Services Compensation Scheme (FSCS), nor will the Financial Ombudsman Service be able to consider a complaint about Liberis. Amounts advanced are subject to status and our underwriting process before any offer can be made.

Webinars and Workshops

ClubV1 Booking System Webinars

These sessions are specifically designed to educate you on the benefits of the our newly improved Booking System.

Matt Bergh

Webinars presented by Sales Manager, Matt.

Alec Schofield

Webinars presented by Sales Executive, Alec.

John Cardno

Webinars presented by Sales Executive, John.

Rhiannon Birkinshaw

Webinars presented by Sales Executive, Rhiannon.

Lucy McPherson

Webinars presented by Sales Executive, Lucy.

Workshops

UK & NI Workshops. Dates to be announced..